Process analysis, or mapping out the steps in your business to figure out where improvements can be made, can help you make your insurance agency even more effective and efficient than it already is. Process analysis will allow you to pinpoint where bottlenecks and redundancies exist, as well as highlight opportunities to improve efficiency and cut costs. Here’s how to get started with your own process analysis.

The 3 Stages of Process Analysis

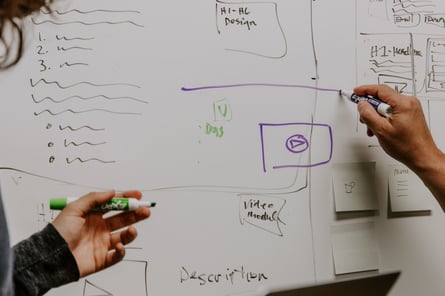

Process analysis typically includes three stages. The first stage, which is used as a baseline comparison for future process analysis, involves identifying resources and processes (the what), as well as documenting each step in a process (the how). Subsequent steps include evaluating your results based on these documented processes (the why) and finally proposing solutions that improve efficiency and benefit both you and your clients.

Identifying Business Improvement Opportunities

When you start to analyze your current processes you may find that many are in need of improvement. Considering the ways that you can improve the way things are done will help to determine how to make your team more efficient and productive. A great place to start is to have each of your team members outline their main processes and outline ideas for improving them.

Improving Client Satisfaction

Now that your employees have gone through process-improvement evaluations, it’s time to turn the focus to your clients. Begin by creating client surveys and having clients fill them out. Once you’ve received and analyzed their feedback, identify weak areas that need improvement and create an action plan. Implement your action plan, start fresh with new surveys, and repeat until all of your clients are happy campers.

Joining AAI as an independent agent will give you the education, support, and guidance you need to succeed and grow your agency. For more information, feel free to contact us.